stock option tax calculator canada

Deduct CPP contributions and income tax. Option grants that qualify for stock option deduction.

Equity 101 How Stock Options Are Taxed Carta

This permalink creates a unique url for this online calculator with your saved information.

. Will currency and stock trading taxes in Canada be the same as futures and options trading taxes for example. Subsection 110 1 of the Income Tax Act allows the employee to report only half of the benefit derived from exercising the employee stock option. Fidelitys tax calculator estimates your year-end tax balance based on your total income and total deductions.

Taxes for Non-Qualified Stock Options. Taxable benefit When a. Ad Fidelity Has the Tools Education Experience To Enhance Your Business.

Lets say you got a grant price of 20 per share but when you exercise your. Under the current employee stock. This calculator illustrates the tax benefits of exercising your stock options before IPO.

Cash Secured Put calculator addedCSP Calculator. Receiving Stock-based Incentives Employee Stock. Stock option plan This plan allows the employee to purchase shares of the employers company or of a non-arms length company at a pre-determined price.

Click to follow the link and save it to your Favorites so. This article assumes that all services were performed in Canada as an employee of a company as opposed to an independent contractor. Taxation at the employees marginal tax rate.

Locate current stock prices by entering the ticker symbol. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. This Tax Insights discusses the new employee stock option rules and answers some common questions on the topic.

Considering certain conditions are met you can claim a deduction. Stock option deduction ie 50 4000 Net Taxable. Under the employee stock option.

Find the best spreads and short options Our Option Finder tool. Please enter your option information below to see your potential savings. When determining the amount of the security option benefit subject to income tax withholding we will permit the employer to reduce the benefit by.

Easily Calculate Your Tax Refund And Get Started On Filing Your Taxes. You will face tax on the 10000 benefit this is where the idea of stock options should be of interest to you. Exercising your non-qualified stock options triggers a tax.

How much are your stock options worth. For example the option price is 10 for 15. See How Easy It Is.

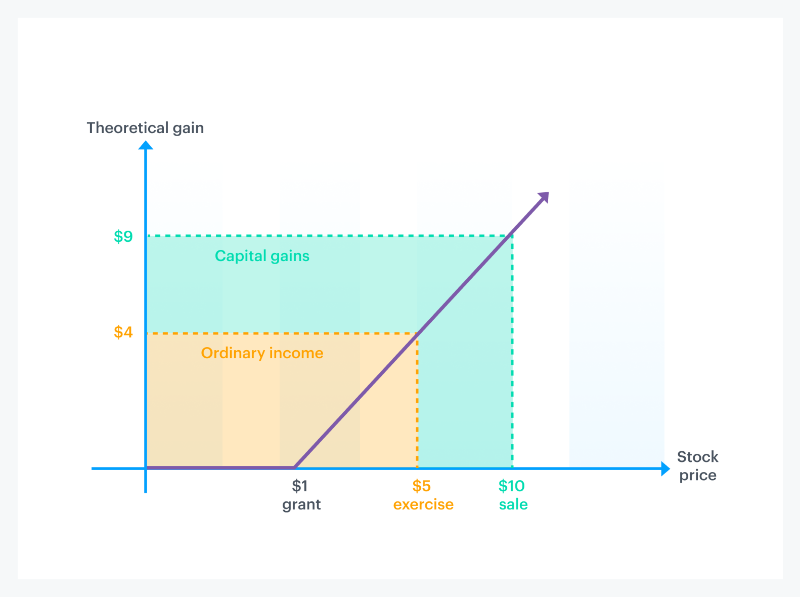

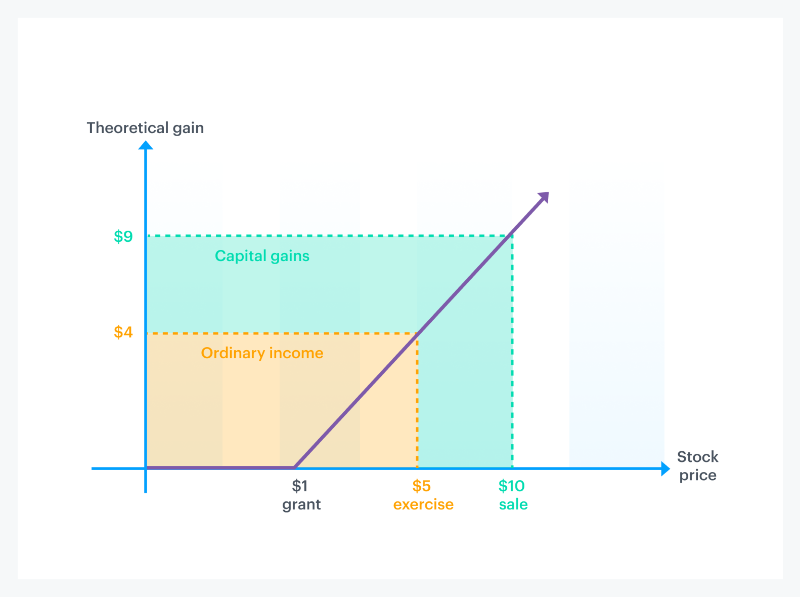

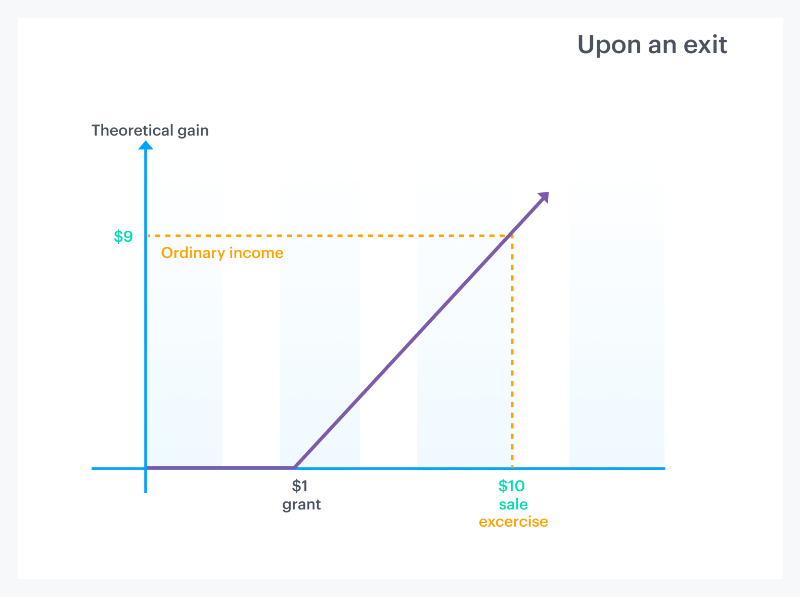

The stock options were granted pursuant to an official employer Stock Option Plan. In our continuing example your theoretical gain is. Stock Option Calculator Canadian Receiving options for your companys stock can be an incredible benefit.

Employee Stock Option Calculator Estimate the after-tax value of non-qualified stock options before cashing them in. The Stock Option Plan. There are two types of taxes you need to keep in mind when exercising options.

The calculator will show your tax savings when you vary your. Budget 2019 proposed an annual cap of 200000 on stock. Poor Mans Covered Call calculator addedPMCC Calculator.

Even after a few years of moderate growth stock options can produce a. Stock Option Deduction Stock option benefit as previously calculated 8000 Less. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

This Tax Insights discusses the new employee stock option rules and answers some common questions on the topic. On the whole the CRA is concerned more with how and why you are trading than. The Stock Option Plan specifies the total number of shares in the option pool.

Ad Get A Quick Estimate On How Much You May Get Back Or Owe With Our Free Calculator. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Option grants that do not qualify for stock option.

It is this deduction that allows stock option benefits to be taxed at the same tax rate applicable to capital gains. Ordinary income tax and capital gains tax. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

Top 6 Candlesticks Stock Trading Learning Stock Trading Strategies Forex Trading Quotes

The Ultimate Guide To Safe Withdrawal Rates Part 1 Introduction Early Retirement Now Saving Quotes Finance Blog Personal Finance Blogs

Passive Income Ideas Passive Income Passive Income Ideas 2021 Passive Income Peer To Peer Lending Income

How Do I Calculate An Ebitda Margin Using Excel Investing Mortgage Payoff Financial

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

8 Canadian Wide Moat Dividend Growth Stocks Seeking Alpha Dividend Canadian Growth

Close To Close Historical Volatility Calculation Volatility Analysis In Python Analysis Implied Volatility Historical

Difference Between Breakeven Point Vs Margin Of Safety Money Management Advice Money Strategy Financial Analysis

Equity 101 How Stock Options Are Taxed Carta

How To Calculate Weighted Average Price Per Share Fox Business

Taxation Of Stock Options For Employees In Canada Madan Ca

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

Calculating The Equity Risk Premium

Secfi Alternative Minimum Tax Calculator

The Free And Easy Way To Calculate Acb And And Track Capital Gains Financial Fitness Investing Money Investing

Simpletax 2017 Canadian Income Tax Calculator Income Tax Income Tax

Personal Balance Sheet How To Create A Personal Balance Sheet Download This Personal Balan Balance Sheet Balance Sheet Template Personal Financial Statement

Understanding Tax Rules For Rental Property Aol Real Estate Rental Property Investment Real Estate Investing Rental Property Rental Property Management