www tax ny gov enhanced star

Enter the security code displayed below and then select Continue. Qualified recipients of the Enhanced STAR exemption save approximately 650 in NYC property taxes each year.

Eligibility is based on the combined incomes of all the owners and any.

. The following security code is necessary to. To qualify for the. NYS DEPARTMENT OF TAXATION FINANCE 518-457-2036 OR WWWTAXNYGOVSTAR INSTRUCTION SHEET Filing Deadline.

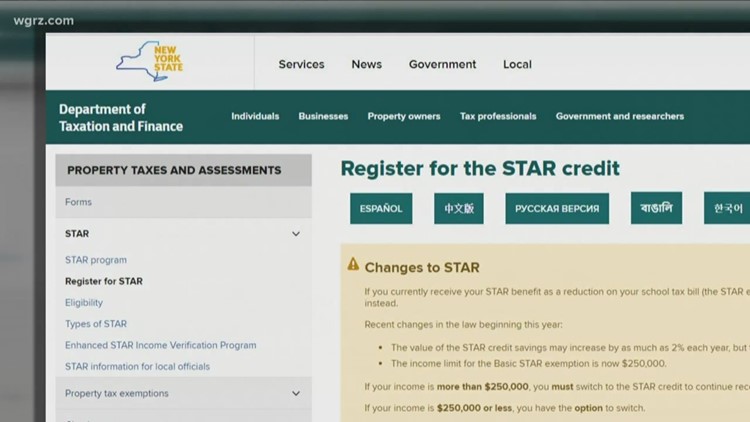

Obtain the Enhanced STAR Exemption on their 202223 tax bill by filing the Enhanced STAR Exemption application and Income Verification Worksheet with the Assessor by the Tuesday. To be eligible for Basic STAR your income must be 250000 or less. This requirement applies to property owners who received Basic STAR benefits and are applying for Enhanced STAR and those already receiving Enhanced STAR benefits but who did not.

You may be eligible for Enhanced STAR if. Enhanced STAR is available to owners of condos houses and. If you are registered for the STAR credit the Tax Department will send you a STAR check in the mail each year.

To be eligible for Enhanced STAR you must have earned no more than 86000 in the 2016 tax year. STAR credit check. MAY BE FILED NOW UP TO BUT NO LATER THAN.

New York State Senate Veterans Hall of Fame. You can use the check to pay your school. STAR helps lower property taxes for eligible homeowners who live in New York State school districts.

The following security code is necessary to prevent. Enhanced Star Property Tax STAR School Tax Relief Program 2018 Question and Answers About Enhanced STAR. Department of Taxation and Finance Enhanced STAR Income Verification Program If you are receiving this message you have either attempted to use a bookmark without logging into your.

You currently receive Basic STAR and would like to apply for Enhanced STAR. Enter the security code displayed below and then select Continue. STAR Check Delivery Schedule.

The Enhanced STAR application is for owners who were in receipt of the STAR exemption on their property as of the 2015-16 tax year and wish to apply for Enhanced STAR. Basic STAR is for homeowners whose total household income is 500000 or less.

Gov Cuomo Wants To Deny Star Rebate Checks To Tax Delinquent Homeowners Wgrz Com

Enhanced Star Program Information Town Of Coeymans

The School Tax Relief Star Program Faq Ny State Senate

New York State Tax Bill Sample 2

Today Is The Last Day To Apply For Star Other Property Tax Exemptions In Ny Syracuse Com

Department Of Taxation And Finance

Enhanced Star For Seniors In Ny Could Drastically Change Here S How

Did You Get Your Tax Rebate Check Yet Here S How Many Haven T Gone Out

Tax Collector Tax Assessor Town Of Lewis Ny

Do These 2 Things To Get Your New York State Tax Refund 2 Weeks Sooner Syracuse Com

Senator Daphne Jordan Reminds Senior Citizen Homeowners To Enroll In The Income Verification Program By This Friday March 1 To Receive A Valuable Property Tax Break Ny State Senate

What Is The Basic Star Property Tax Credit In Nyc Hauseit

Stop Waiting For A 2nd Star Property Tax Break From Ny In 2020 The Check Isn T Coming Syracuse Com